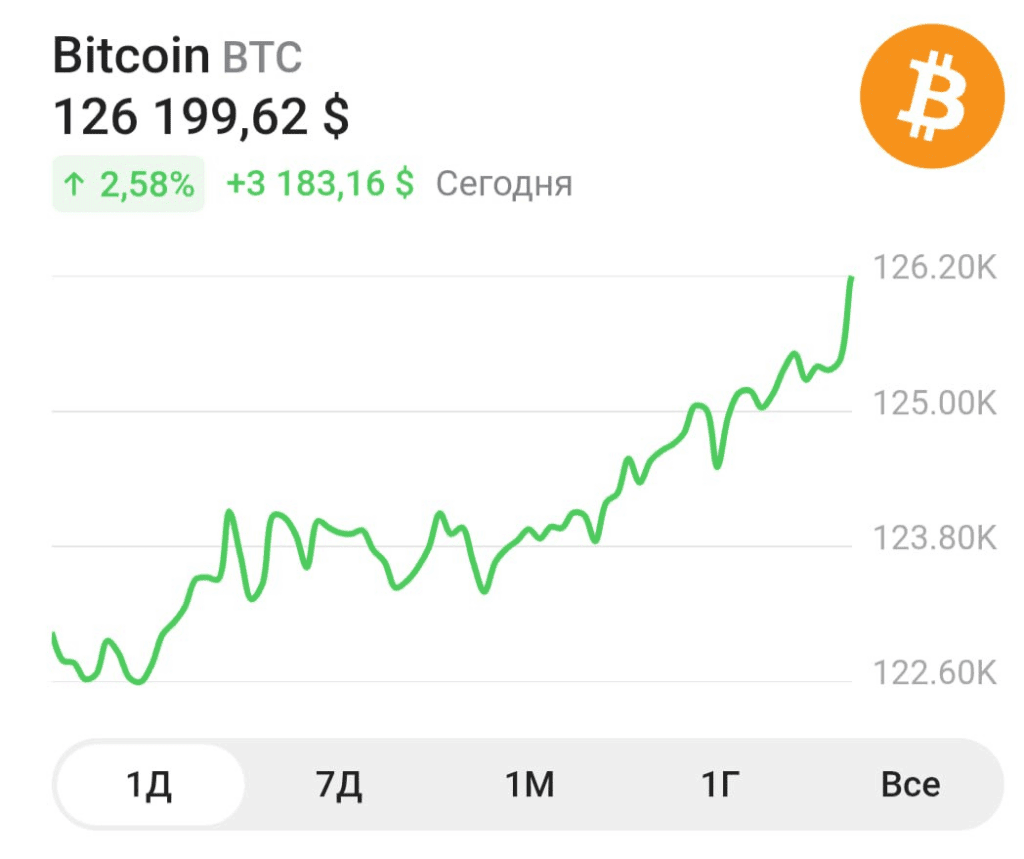

This morning, the price of bitcoin (BTC) officially exceeded the historical maximum of $126,000, breaking the previous record set at the end of 2021. This event has become a key moment for the entire crypto market and marks the beginning of a new phase of the bullish cycle, underpinned by institutional demand, capital inflows into ETFs, and expectations of Fed rate cuts.

A new record and what’s behind it

The bitcoin rally began at the end of September, when the largest American spot ETFs on BTC (including products from BlackRock, Fidelity and Grayscale) recorded record amounts of inflows of funds. Over the past two weeks, the funds have received more than $4 billion, which has become one of the most powerful institutional impulses in the history of the crypto market.

The psychologically important mark of $126,000 was overcome in the morning session of the Asian markets. After the breakdown, the price briefly reached $126,800 before correcting to the area of $125,000. But even taking into account fluctuations, bitcoin has steadily gained a foothold above the previous high of 2021 — $69,000 — by more than one and a half times.

The main driving force behind the growth has been institutional investors using ETFs as a secure tool to enter digital assets. Interest from private traders has also grown, especially against the background of growing expectations that in 2026, the massive introduction of cryptocurrencies into payment systems and fintech services may begin.

Factors that accelerated the price

- The ETF effect. Since the approval of spot ETFs for bitcoin, the market has received a strong influx of liquidity. Products from BlackRock and Fidelity have become an alternative to direct purchase of BTC — institutions are massively entering the market through stock instruments.

- Reduction of emissions (post-halving). After the April halving of 2024, the supply of new bitcoins decreased by 50%, which, with stable demand, led to a structural deficit.

- Macroeconomics. Expectations of a reduction in interest rates by the Fed at the end of 2025 make risky assets more attractive. Investors are returning to crypto as an alternative to gold and technology stocks.

- The growing interest in tokenized assets. The development of the real-world assets (RWA) market has increased interest in the blockchain infrastructure and in bitcoin as the basic “digital gold” of the new economy.

- Shortage of liquid BTC on exchanges.

The number of coins on centralized exchanges has reached its lowest level in 6 years — less than 11% of the total circulation. This increases the scarcity effect as demand increases.

Market reaction

Other leading cryptocurrencies have also grown against the background of bitcoin’s record. Ethereum rose above $3,900, Solana approached $230, and the index of total capitalization of the crypto market exceeded the mark of $4.8 trillion for the first time in history.

Traders are recording an increase in open interest in the futures markets to new highs of more than $25 billion, which indicates an influx of new participants and high expectations for continued growth.

At the same time, volatility is also increasing: according to analysts, over the past 24 hours, the liquidation of short positions has exceeded $ 400 million, which also contributed to the acceleration of growth.

What’s next: expectations and risks

Experts are divided in their opinions. Some believe that the current level may become a new “starting point” before rising to $ 150,000–$180,000, others warn of a possible correction by 10-15% after such a rapid breakthrough.

Key factors to observe:- the behavior of large ETF investors and the volume of new inflows;

- Fed policy and macroeconomic indicators of inflation;

- further dynamics of the dollar index (DXY);

- miner activity, especially in conditions of reduced remuneration;

- the development of regulation of the crypto market in the USA and the EU.

At the same time, even skeptics admit that bitcoin has finally established itself as a global asset class. More and more investors are considering it not as a speculative instrument, but as a digital equivalent of gold, protected from inflation and emission risks.

Symbolic meaning

Exceeding the $126,000 mark is not just a price record. This is a psychological frontier that shows that the crypto industry has come a long way from the speculative enthusiasm of 2017 to a mature, institutionally recognized market.

Now bitcoin has officially become an asset that competes with traditional financial instruments in terms of liquidity and reliability. In the eyes of investors, it ceases to be a “digital exotic” and turns into a tool for preserving the capital of the 21st century.

Result

The historical growth of bitcoin above $126,000 is not just a price jump. This is the culmination of a multi-year transformation of the market, where digital assets are becoming a full-fledged part of the global economy.

Now investors’ attention is focused not on whether bitcoin has “bottomed out”, but on the question: where will the next peak be — $150,000, $200,000 or higher.

One thing is already clear — the crypto era has entered a new phase, and bitcoin has once again confirmed its status as the leader of digital money.

Sources:

- The international monetary fund Crypto — Bitcoin Surges Past $126,000 is a New All-Time High

- CoinDesk — BTC breaks records amid institutional ETF inflows

- (Reuters) — Bitcoin hits fresh peak of the market anticipates the Fed rate cuts

- The Block — ETF inflows and post-halving scarcity fuel Bitcoin rally