Traders using Pocket Option, they understand the importance of timely entry into promising assets. A detailed analysis of such projects is part of the training program at Trading Academies, where they teach you how to analyze not only charts, but also fundamental factors.

What is Aster?

Aster is the result of the merger of two DeFi protocols: Astherus (a platform for managing liquidity and profitability) and APX Finance (a decentralized perpetual contracts exchange). The merger took place in December 2024, and the official launch under the Aster brand took place on March 31, 2025.

The platform offers perpetual contract trading and spot trading on several blockchains: BNB Chain, Ethereum, Solana and Arbitrum. The main difference from competitors is the ability to use profitable assets (liquid staking tokens and interest—bearing stablecoins) as collateral for margin trading.

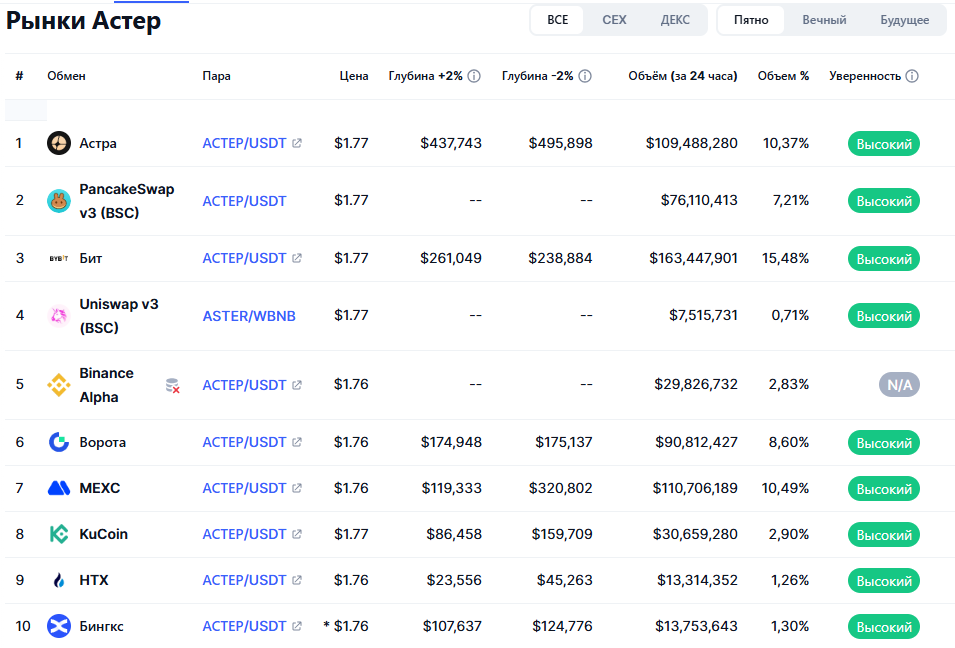

At the time of writing, ASTER is in the top 50 by capitalization among all cryptocurrencies with an indicator of about $3 billion. The daily trading volume exceeds $1.2 billion, and the platform itself processes over $9 billion in transactions per month.

Who created the project

The Aster team adheres to the Web3 philosophy — they do not flaunt the identity of the founders, preferring that the product speak for itself. The team is known to include former Binance Futures employees, quantum traders, and developers with experience at Goldman Sachs.

Prior to the merger, APX Finance had been operating since 2021, serving more than 167,000 traders and processing $329 billion worth of transactions. Astherus received an investment from Binance Labs (now YZi Labs) in November 2024. The strategic funding round was completed before the rebranding.

On September 19, 2025, the project received public support from Changpeng Zhao (CZ), co-founder of Binance, who wrote in X: “Well done! Good start. Keep building!” This message became a catalyst for the growth of the token’s price and attracted the attention of thousands of traders.

Tokenomics and metrics of the offer

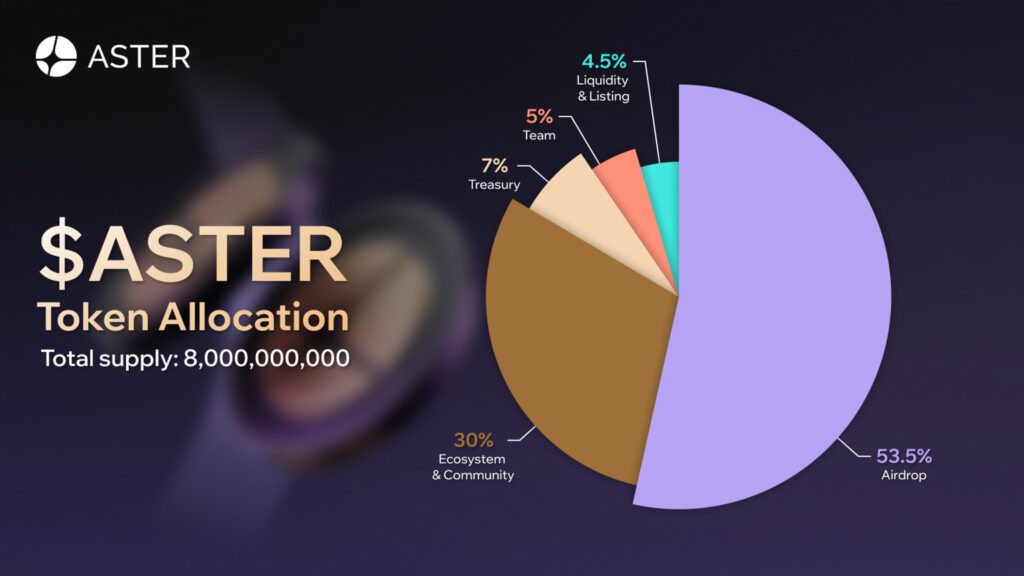

The total issue of ASTER is 8 billion tokens with this distribution:

- 53.5% (4.28 billion) — airdrops and rewards to the community.

- 30% (2.4 billion) — ecosystem development.

- 7% (560 million) is the treasury of the project.

- 5% (400 million) — the development team.

- 4.5% (360 million) — providing liquidity and listings.

There are about 1.65 billion tokens in circulation (20.7% of the maximum issue). The airdrop program is distributing 320 million ASTERS in the second season, which ends on October 5, 2025. At the current price, this is about $612 million, a significant amount that can create selling pressure.

Holders of old APX tokens could exchange them for ASTER in a 1:1 ratio from September 17, 2025. The later the exchange takes place, the worse the exchange rate — the mechanism encourages rapid conversion.

How Aster Works

The platform offers several trading modes:

- Pro Mode is a full—fledged orderbook with deep liquidity. The fees are 0.01% for the maker and 0.035% for the taker. Advanced tools are available: grid trading, hidden orders, 24/7 stock trading.

- Simple Mode (1001x) is a simplified one—click interface. Leverage up to 1001x, protection against MEV attacks, use of the ALP liquidity pool.

- Spot Trading is a classic spot trading with low fees.

- Aster Earn — passive income products, including liquid staking token asBNB and profitable stablecoin USDF.

A special feature of the platform is the Hidden Orders feature. Traders can place completely invisible limit orders that are not displayed in the glass. This protects major players from front-running and manipulation.

The technical infrastructure includes its own Aster Chain blockchain (currently in beta testing), which will ensure high performance and privacy of transactions. Integration with the Pyth, Chainlink and Binance Oracle oracles guarantees accurate asset prices.

The value and innovativeness of the token

ASTER performs several functions in the ecosystem:

- Protocol management. Token holders vote for changes to the platform’s parameters, the addition of new assets, and the allocation of treasury funds.

- Reduced fees. Paying commissions in ASTER gives you a 5% discount on all transactions.

- Staking and profitability. A portion of the platform’s revenue is distributed among ASTER’s stakeholders through the revenue sharing mechanism.

- The deflationary model. The protocol buys tokens from the market at the expense of a portion of the commissions, creating constant buyer pressure.

Aster has occupied a unique niche — trading derivatives using profitable assets as collateral. A trader can hold asBNB (the liquid staking version of BNB) and earn income from staking, while simultaneously using these tokens for margin trading. Double returns attract institutional players.

According to Dune Analytics, the platform has processed $522 billion worth of transactions since launch, attracted 2 million users, and has a TVL of $464 million. On September 24, the daily trading volume reached a record $24.7 billion, surpassing Hyperliquid’s figures.

Technical analysis

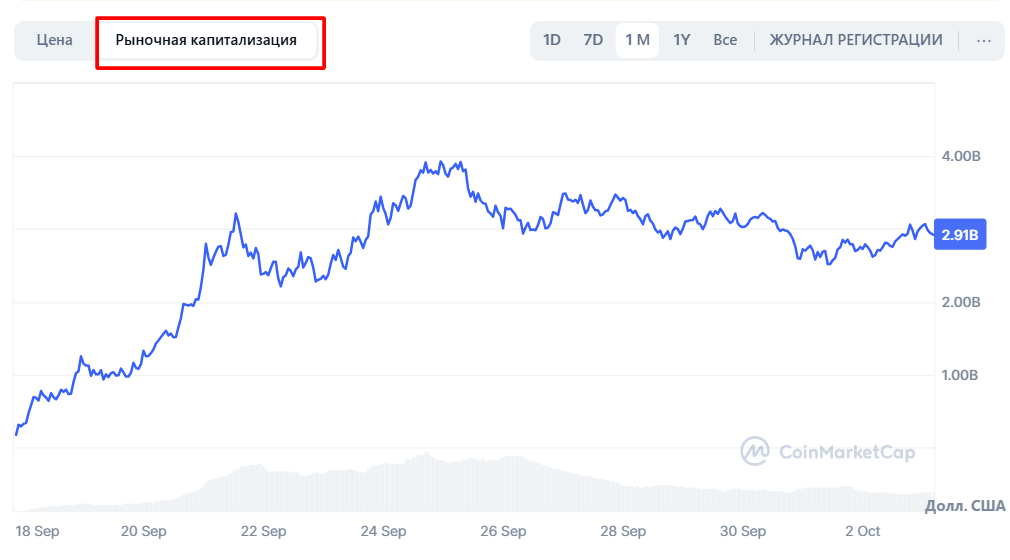

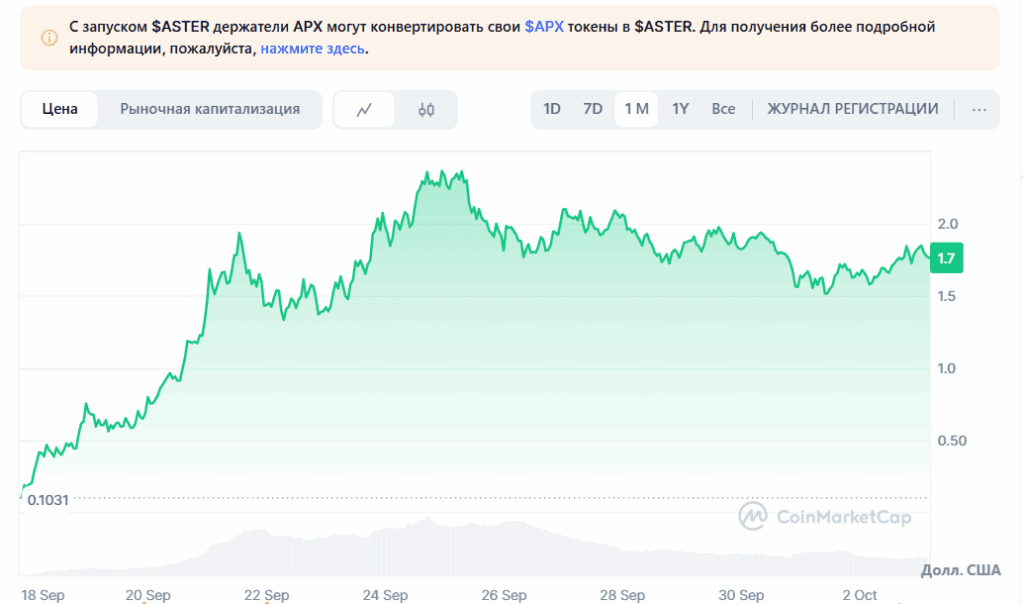

For an asset with a trading history of less than two weeks, classical technical analysis has limited use. Nevertheless, it is possible to identify key levels:

The historical maximum of $2.42 was reached on September 24, 2025. After that, the price rolled back to the range of $1.60-1.90, where a consolidation zone was formed.

Support is at $1.40, the minimum after the first wave of growth. The psychologically important level of $1.00 can act as a strong support in the event of a deep correction.

Resistance is located around $2.00, a round level and a zone of previous local highs. A breakdown of this mark will pave the way for a retest of the historical peak.

Trading volumes remain consistently high, which indicates continued interest. The RSI on the daily chart is in the neutral zone around 50, giving no obvious overbought or oversold signals.

Forecast for 2026

Analysts give a wide range of forecasts for ASTER for 2026:

CoinPedia predicts a range of $1,037-3,111 with an average price of $2,074. SDK expansion for brokers and integration with third-party trading applications may become growth drivers.

StealthEX sees growth potential up to $3.5-4.0, provided it maintains leadership in trading volumes among DEX. The launch of a full-fledged version of Aster Chain can be a catalyst.

The base case assumes a price in the range of $1.50-2.50. The project should retain users after the completion of the airdrop program and prove the sustainability of the business model.

The key risk is unlocking the tokens of the team and early investors. Westing’s schedule is not fully transparent, which creates uncertainty. The CEO of the Leonard project confirmed that vesting for airdrop tokens is being considered, but no final decision has been made.

Forecast for 2030

Aster’s long-term prospects depend on the development of the decentralized derivatives market:

The optimistic scenario (CoinPedia) assumes growth to $15,753 while capturing a significant share of the perp DEX market. If Aster becomes the main platform for institutional derivatives trading, the capitalization could exceed $100 billion.

A moderate forecast sees ASTER in the range of $5-10. This implies maintaining the current market share and organic growth along with the overall expansion of DeFi.

Conservative estimate is $3-5 per token. Increased competition from Hyperliquid, the emergence of new players, and regulatory restrictions may constrain growth.

StealthEX notes: if Aster can keep the average daily trading volume above $10 billion and expand its functionality to a full-fledged ecosystem (lending, synthetic assets, options), the token can reach $20-25 by 2030.

Where to buy ASTER

The token is available on the following platforms:

- Bybit is the first centralized exchange to add ASTER.

- Gate.io — the main trading pairs with USDT.

- MEXC — spot and futures trading.

- BingX is a margin trading with leverage.

- Aster DEX is a native platform with the lowest fees.

- PancakeSwap is the main DEX on the BNB Chain.

- Uniswap — for trading on Ethereum.

Important: the token is traded as BEP-20 on the BNB Chain. When withdrawing money to your wallet, make sure that the correct network is selected. Contract: 0x000ae314e2a2172a039b26378814c252734f556a.

Investment risks

Despite the impressive start, ASTER carries significant risks.:

- The concentration of tokens. According to blockchain analysts, 79% of tokens are in three wallets. This creates a risk of manipulation and sudden sales.

- Dependence on airdrops. Most of the activity may be related to airdrop farming. After October 5, 2025 (the end of the second season), an outflow of users is possible.

- Competition with Hyperliquid. Despite record volumes, Hyperliquid retains 70-80% of the perp DEX market. The leader has more resources and a user base.

- Accusations of wash trading. Critics claim that some of the volume is an artificial hype to attract attention. The platform denies this, but doubts remain.

- Technical immaturity. Aster Chain is in beta. The hidden orders feature may contain vulnerabilities. DeFi has a history of hacking new protocols.

- Regulatory risks. Trading derivatives with 1001x leverage may attract the attention of regulators. In some jurisdictions, such products are already prohibited for retail investors.

Conclusion

Aster demonstrates how proper timing and the support of influential figures can bring a project to the top. The merger of two working protocols, backing from YZi Labs, and public support from CZ — everything worked out well.

The platform offers real innovation: hidden orders, the use of profitable assets as collateral, stock trading 24/7. But success will depend on the ability to retain users after the end of the rewards program.

For active traders on Pocket Option ASTER volatility creates opportunities for short-term trades. Intraday fluctuations of 10-15% are common for this asset.

Do you want to learn how to analyze similar projects and find entry points? The Trading Academy offers courses on technical and fundamental analysis of cryptocurrencies, risk management when working with volatile assets.

This article is for informational purposes only and is not an investment recommendation. Cryptocurrencies are high—risk assets that can lose a significant portion of their value in a short period of time. Always do your own research (DYOR) before making financial decisions.