Bybit is one of the most popular platforms for cryptocurrency copy trading thanks to its user-friendly interface and advanced analytics tools. According to experts at Trading Academy, the automated copy trading feature helps beginners learn from professionals, although it doesn’t guarantee profit. The exchange offers two copy trading modes with different levels of control and a risk management system. The Pocket Option platform also develops social trading for various instruments. Let’s look at how it works, the pitfalls, and how to avoid common mistakes.

Bybit is one of the most popular platforms for cryptocurrency copy trading thanks to its user-friendly interface and advanced analytics tools. According to experts at Trading Academy, the automated copy trading feature helps beginners learn from professionals, although it doesn’t guarantee profit. The exchange offers two copy trading modes with different levels of control and a risk management system. The Pocket Option platform also develops social trading for various instruments. Let’s look at how it works, the pitfalls, and how to avoid common mistakes.

What is copy trading on Bybit?

Copytrading on Bybit is a feature that automatically replicates trades from successful traders to your account. The platform acts as an intermediary between master traders (leaders) and copiers, providing the technical infrastructure for synchronizing positions.

Key Features:

- Works only with futures contracts (Derivatives Account).

- Minimum deposit requirements are set by the exchange.

- Two modes: Classic (simplified) and Pro (advanced settings).

- The leader’s commission is a share of the copier’s profit, determined by the trader.

- Standard exchange trading fees for each transaction.

Registering on Bybit using our link gives you bonuses up to $6,135 on your deposit.

How does copy trading work on Bybit?

The mechanics are based on automatic synchronization between the leader’s and the copiers’ accounts.

Work process:

- The leader opens a position on their account—the system records all parameters.

- The algorithm transmits data to all subscribers of this leader.

- Proportional positions are automatically opened on copier accounts.

- When the leader closes a position, all copiers receive an exit signal.

The position size is calculated proportionally, taking into account the difference in deposits and the set multiplier. The multiplier is typically set below one to further reduce risks.

Important: Copying begins from the moment you subscribe. Already open positions of the leader are not automatically duplicated. The system takes into account the available margin and adjusts the amount if full copying is not possible due to insufficient funds.

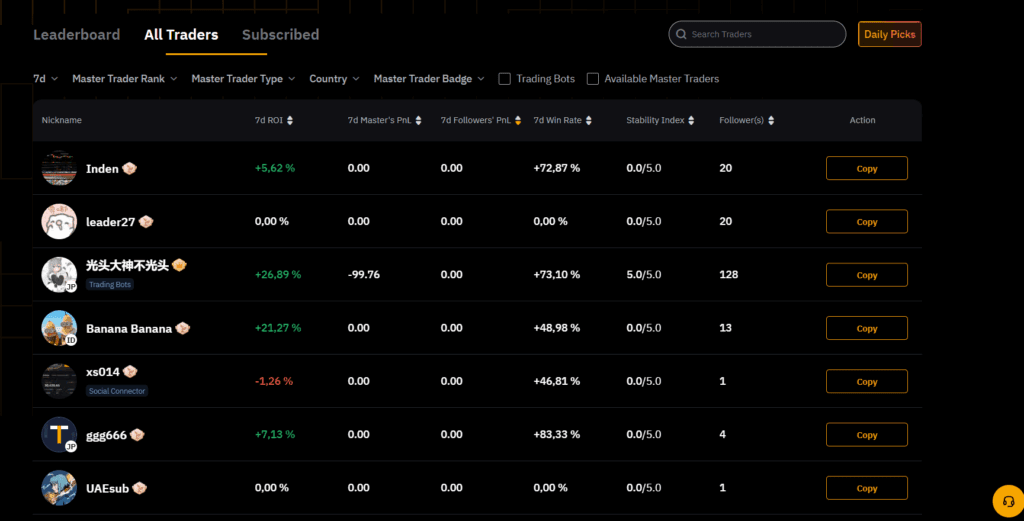

Bybit Leaders: Who They Are

Master traders undergo a selection and verification system before achieving leader status.

Basic requirements:

- Minimum deposit to create a public profile.

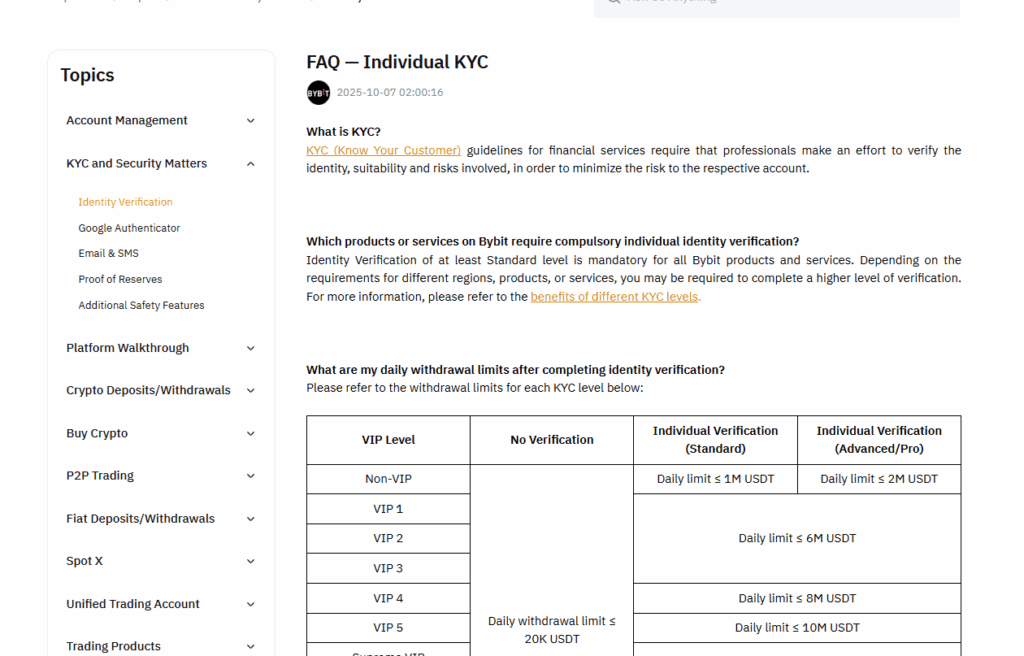

- Mandatory KYC verification.

- Public trading history of at least 30-60 days.

Leaders receive a commission as a percentage of copiers’ profits. They set their own commission, which influences their profile’s attractiveness.

The main types of leaders:

- Conservative — moderate leverage, small drawdowns, stability.

- Balanced – average level of risk and return.

- Aggressive – high leverage, large drawdowns, pursuit of high profits.

- Scalpers — dozens of trades a day on short timeframes.

Professional leaders typically specialize in specific assets or strategies. Choose traders whose specialization aligns with your understanding of the market.

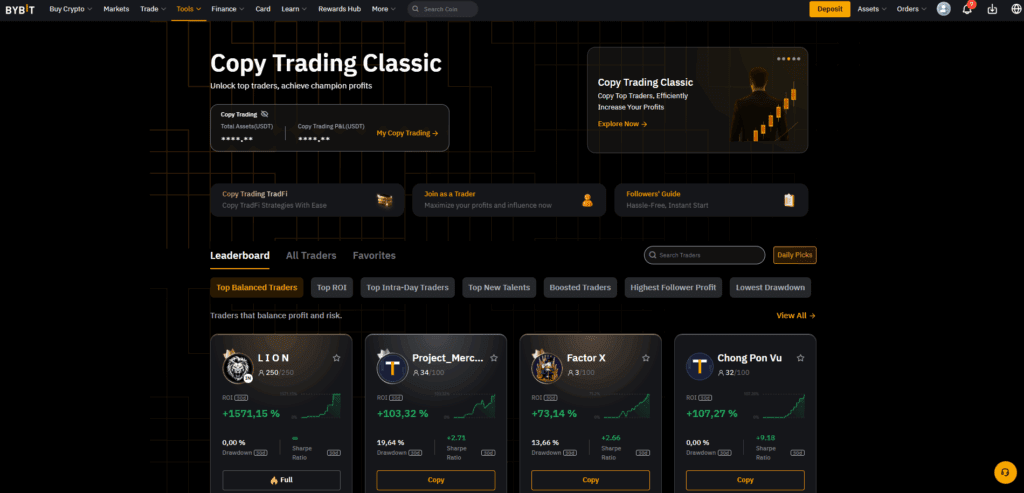

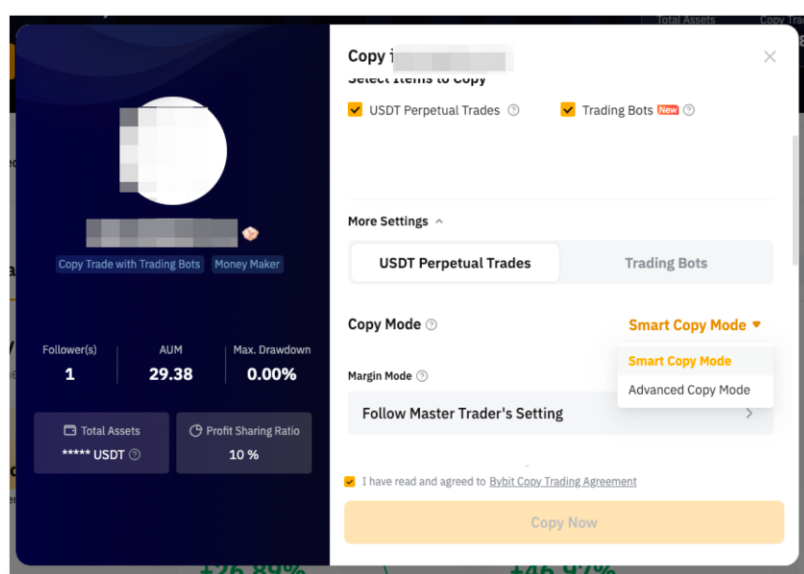

Auto-Follow: Classic and Pro Modes

Classic Mode is a simplified mode with minimal settings for beginners. You specify the total amount and maximum drawdown, and the system automatically manages the rest.

Pro Mode — advanced mode with detailed settings:

- Flexible copy multiplier settings.

- Exclusion of certain cryptocurrencies.

- Setting your own stop-losses.

- Limit the maximum number of positions.

- Detailed control over margin usage.

Beginners are better off starting with Classic, and after mastering it, moving on to Pro to fine-tune risks.

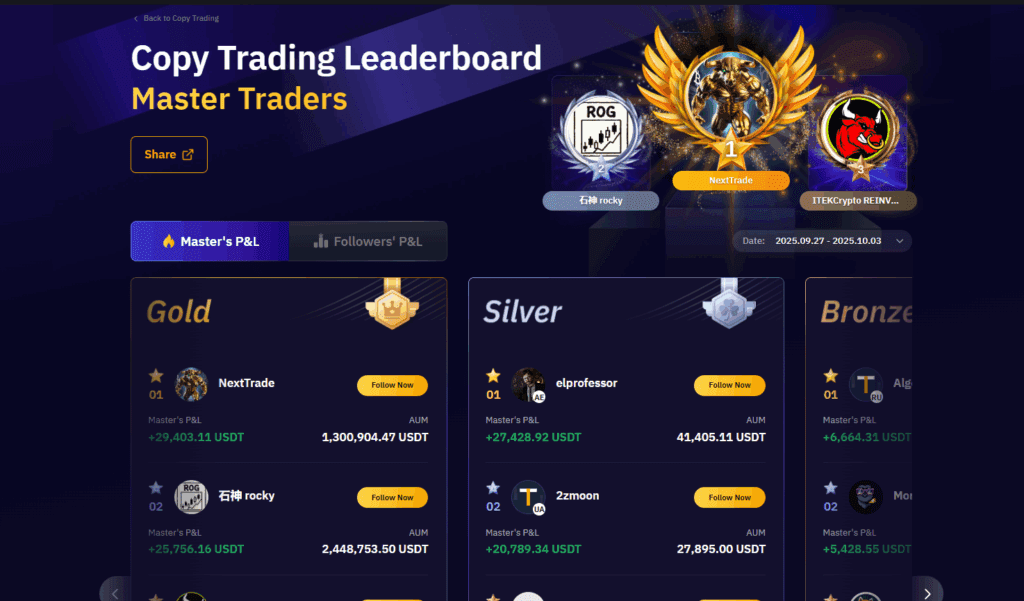

AUM on the stock exchange: what does it mean?

AUM (Assets Under Management) is the total amount of copier funds held by a specific leader. A key indicator of trust and popularity.

AUM in Copy Trading on Bybit

What does AUM show:

- The total capital of all subscribers.

- Community Trust Level.

- Result stability – high AUM accumulates over years.

An AUM that’s too low is a warning sign—it could be a new trader or their results are inconsistent. AUM that’s too high creates slippage risks, when large orders affect the price. Monitor your AUM dynamics: a sharp decline indicates a period of poor results and a massive outflow of subscribers.

How much can you earn from copy trading

Profitability varies greatly depending on the leader, market conditions, and settings. High returns are always accompanied by proportionally high risks.

Factors Affecting Profit:

- The leader’s commission reduces net profitability.

- Exchange trading commissions for each transaction.

- Price slippage worsens results relative to the master account.

- Futures funding rates can be a benefit or a loss.

Your actual return will always be lower than the leader’s due to fees and slippage. Don’t expect a stable linear return—the crypto market is cyclical. Evaluate results over quarters and years, not weeks.

Liquidation Risks in Copy Trading

Liquidation is the forced closure of positions by the exchange due to insufficient margin. This is a critical risk when trading with leverage, as it can wipe out your deposit.

Problem: The liquidation conditions for a copier differ from those of a leader. If the leader has a large deposit, it will withstand the drawdown. A copier with a smaller capital may be liquidated sooner.

Risk factors:

- High copy multiplier.

- Copying multiple aggressive leaders at once.

- Insufficient free margin reserve.

- Extreme market volatility.

- Using maximum leverage by the leader.

Protection from liquidation:

- Keep at least 30-40% of your deposit in free margin.

- Avoid leaders with extreme leverage.

- Set stop-losses below the liquidation level.

- Monitor your margin level daily.

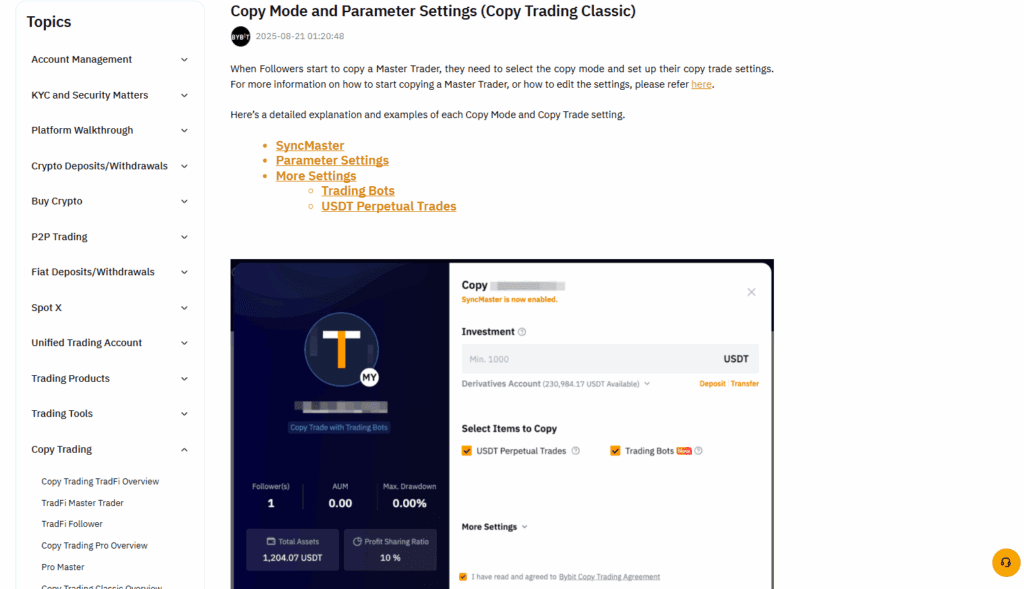

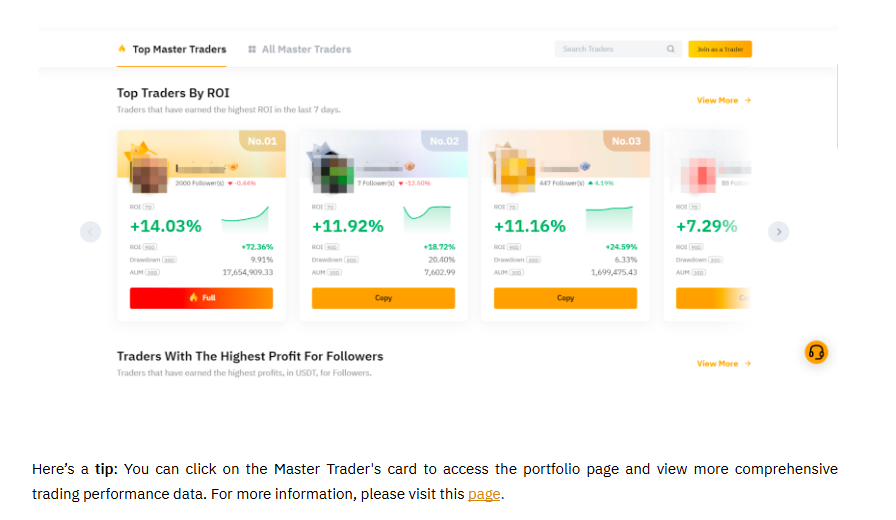

How to choose a trader on Bybit

Choosing the right leader determines a large part of success.

What to analyze:

- ROI for the last 3-6 months, not just the current period.

- Maximum drawdown for the entire period of trading.

- Win rate is the percentage of profitable trades.

- Average duration of transactions.

- At least 6 months of trading history.

Red flags:

- Sharp jumps in yields followed by crashes.

- Increasing positions after losses.

- Concentration of profit in 2-3 transactions.

- Trading only one cryptocurrency.

Study the equity chart: a smooth, ascending line is a sign of a sustainable strategy. A sawtooth chart indicates aggressive trading. Read copiers’ comments critically—experienced followers will point out problematic areas.

Step-by-Step Guide: How to Get Started

Step 1. Registration and Verification Register with Bybit and complete KYC verification—without this, access to copy trading is limited.

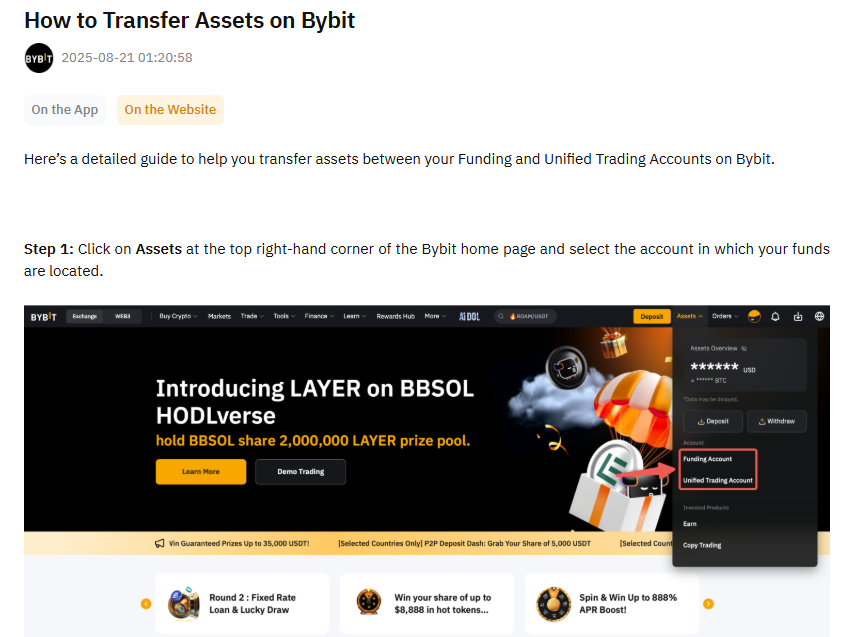

Step 2. Account Funding Make a deposit and transfer funds to your Derivatives Account via the “Assets” → “Transfer” section.

Step 3. Copy Trading Section Open the “Copy Trading” section in the main menu – you will see a list of leaders with basic statistics.

Step 4. Filtering and Selection Use filters by ROI, drawdown, and trading period. Explore the top leaders based on your chosen criteria.

Step 5. Profile Analysis Open the trader’s profile, study the equity chart, trade history for several months, and asset distribution.

Step 6. Setup and Launch Click “Copy,” select the mode (Classic or Pro), enter the amount, and set drawdown limits. Confirm and launch the copy.

Step 7. Monitoring Track your results in the “My Copy Trading” section. Set up alerts for significant changes.

How to Manage Your Capital Properly

Basic principles:

- Don’t allocate more than 20-30% of the deposit to one leader.

- Diversify between 3-5 traders with different strategies.

- Keep at least 30% in free margin as a reserve.

- Use a multiplier below one to reduce risks.

- Reinvest only part of your profits and withdraw the rest.

Diversification strategy: Spread your capital among a conservative leader, two moderate ones, and one aggressive one. This will balance risk and return.

Rebalancing Rules:

- Review each leader’s performance monthly.

- Disable copying during critical drawdowns.

- Don’t increase volumes after losses.

- Add new leaders gradually, starting with minimal amounts.

Never invest your last money or borrowed funds. Use only available capital.

Should I Start Copy Trading on Bybit?

Suitable for:

- For beginners who want to learn by doing.

- For busy people without time for constant monitoring.

- For investors to diversify through different strategies.

Who is not suitable for:

- For people with low volatility tolerance.

- For those looking for a stable passive income without drawdowns.

- For those who cannot afford to lose capital.

Copytrading is no substitute for training. Even when copying successful traders, you need to understand the basic principles of risk management and technical analysis. Start with a minimal amount to master the interface. Only after achieving successful results over 2-3 months should you increase your investment.

Copytrading on Pocket Option

The Pocket Option platform has implemented copy trading for short-term contracts ranging from 60 seconds to several hours. Simplified mechanics without leverage reduce the risk of liquidation. A demo mode allows you to test copy trading without real investment.

The social trading system allows you to monitor other traders’ actions in real time and selectively copy interesting trades. A rating system evaluates traders based on win rate, consistency of results, and number of followers.

Critical: Binary options trading for retail investors is prohibited in countries of the European Economic Area (including Germany) according to the ESMA decision. Services are not available to residents of the EEA, the UK, the US, and certain other jurisdictions. Be sure to check the legality of using the platform in your country.

Reviews: What Users Are Saying

Positive reviews note:

- User-friendly interface and detailed statistics.

- Possibility of diversification between traders.

- Transparency of results and transaction history.

- Fast execution with minimal slippage.

Negative ones indicate:

- High commissions eat up some of the profits.

- The difficulty of choosing a stable leader.

- Liquidation risks with aggressive strategies.

- Even top leaders experience long drawdowns.

A typical success story: careful selection of a few conservative leaders, capital diversification, and a low multiple. Over 6-12 months, moderate returns are achieved with controlled drawdowns. The key is patience and discipline.

A typical failure story: choosing a leader with the highest ROI for the month, investing the entire deposit, high multiplier. Hitting a drawdown, losing a large portion of capital, panic-induced shutdown.

Experienced copiers recommend: start small, test several leaders in parallel, keep your emotions under control, and regularly review your portfolio.

Critical Trading Risk Warnings

Copytrading cryptocurrency futures with leverage carries extremely high risk and can lead to a complete loss of funds. According to European regulators (ESMA, FCA), 74-89% of retail accounts lose money when trading leveraged derivatives.

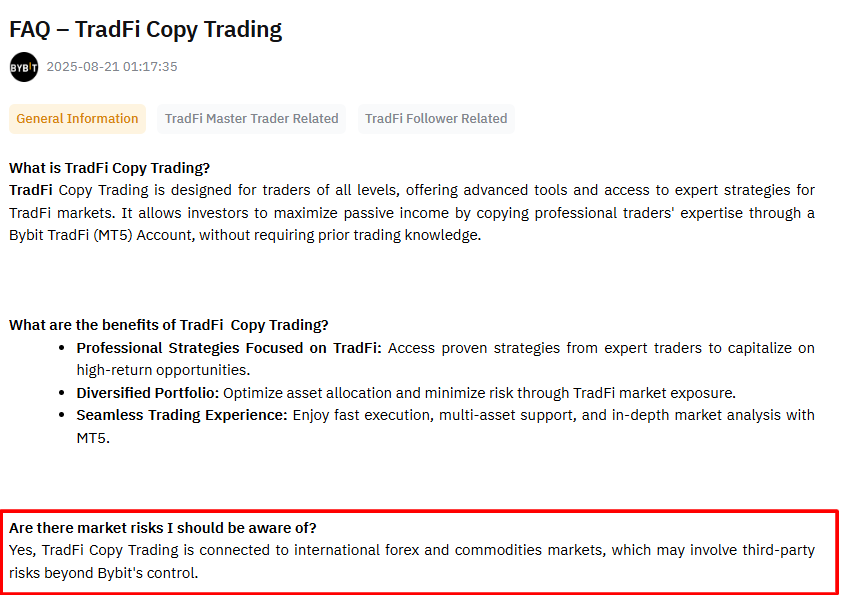

TradFi Risks: Factors Beyond Bybit’s Control

Cryptocurrency volatility increases risks. Prices can change by 10-30% in a matter of hours, leading to rapid liquidation of positions. Even successful leaders experience significant drawdowns. Copiers with less capital can be liquidated before the market reverses.

Slippage and execution delays create additional costs. Your entry price is lower than the leader’s, and fees reduce your overall profitability. The actual profitability of a copier is usually lower than that of a master account.

Psychological risks are dangerous. A false sense of security from delegating decisions leads to underestimating risks and excessive leverage. The desire to recoup losses by increasing the multiplier or switching to aggressive leaders leads to disaster. Panic-induced shutdowns during a drawdown lock in losses before recovery.

Technological risks include infrastructure failures, platform unavailability, and liquidity issues. During periods of extreme volatility, execution may be delayed, leading to worse prices or missed trades.

Invest only with funds you can afford to lose. Never use borrowed money, loans, or funds for housing, education, or healthcare. Copy trading should not threaten your financial well-being.

Don’t view copy trading as a get-rich-quick scheme or a solution to financial problems. Past results do not guarantee future profits. Any promise of a guaranteed income is a scam.

This article is for informational purposes only and does not constitute financial advice. All trading decisions are made at your own risk. Before you begin, be sure to research the risks and ensure you understand all aspects of the instruments used.

Conclusion

Copytrading on Bybit provides tools for automatically copying the strategies of successful traders, but it requires a conscious approach, careful analysis of leaders, and strict discipline in money management. Success is only possible with realistic expectations and an understanding of all the risks.

The Pocket Option platform offers an alternative approach to social trading with a focus on short-term contracts. For a fundamental understanding of financial market principles and risk management, explore the educational programs at the Trading Academy, which presents up-to-date techniques for working with various instruments and capital protection strategies.